Please visit your MyUCCS portal to review any outstanding financial aid documents. Helpful financial calculators to help student loan borrowers evaluate financial aid and. Please be advised that no aid or loans can be disbursed until these items are received. Until all requested documentation is turned into the financial aid office, your financial aid award is tentative and may be revised. You may be requested to provide additional documentation to complete your financial aid file. Your eligibility for financial aid may have been determined using estimated or incomplete information from your completed FAFSA.

#Finaid loan calc plus

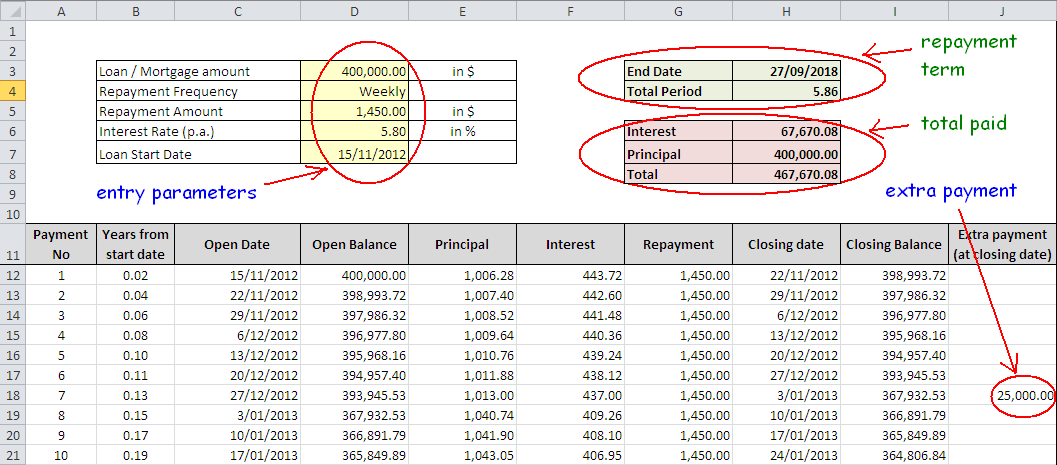

Graduate Students may be eligible for a Graduate PLUS loan. You will be awarded Federal Direct Unsubsidized loan or Parent PLUS loan to meet your remaining unmet need plus your EFC. UCCS will award need-based grants, scholarships, work-study, and loans for which you are eligible according to the UCCS packaging policy. (the maximum amount of need-based aid you may receive) (average cost of attendance for In-State Freshman) These values represent the cost of a single term of enrollment, so multiply by two to estimate costs for the entire academic year. This loan calculator can be used with Federal education loans (Stafford, Perkins and PLUS) and most private student loans. It shows the interest savings and the number of payments saved from the repayment schedule as compared with a regular loan that has no prepayment. To find your cost of attendance, sum the appropriate values in each category below. This Loan Payment Calculator computes an estimate of the size of your monthly loan payments and the annual salary required to manage them without too much financial difficulty. This Prepayment Calculator shows the impact of making regular extra payments on the loan. The following values are used to calculate your cost of attendance.

Note: The total Cost of Attendance reflects the maximum amount of financial aid you may receive for the period covered by financial aid award offer.

#Finaid loan calc full

If you will be enrolled less than full time for your program of study, please contact our office. The estimated financial aid budget that is included in your award letter reflects full-time enrollment. If you would like to calculate your tuition and fees for a term, visit the Student Financial Services Bill Estimator. Cost of Attendance (Undergraduate) Net Price Calculator MyinTuition. Your cost of attendance is an estimate! Your actual billed tuition and fees will not match the averages used for the cost of attendance calculation. Borrowers can view their loan balances and check Pell Grant status by logging. Your COA includes estimates of tuition, fees, books, room, board, transportation, and other misc. Your EFC is used to determine if you are eligible for need-based aid.Įach year the Financial Aid Office creates budgets reflecting the average cost for resident and non-resident students to attend UCCS for one academic year. The information you provide on the FAFSA is used to calculate how much you (and your parents, if you are a dependent student) are expected to contribute to your educational cost. Your EFC is calculated using a formula established by the federal government. Your EFC and Your UCCS Cost of Attendance will determine the amount of financial aid you are eligible for. Calculate payment, interest rate, loan amount or term for a personal loan or line of credit.

#Finaid loan calc free

Cornell applies a proportional methodology to remarried parents.īrowser compatibility: Chrome, Firefox, and the latest version of Internet Explorer (IE11 on Windows 8.1).After you have filed your Free Application for Federal Student Aid (FAFSA), you will receive your Student Aid Report (SAR) which will tell you your determined Expected Family Contribution (EFC).

0 kommentar(er)

0 kommentar(er)